Essay

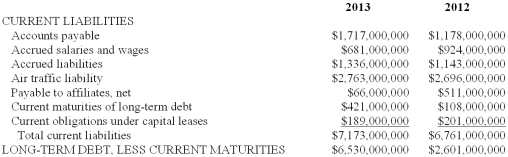

In its 2013 annual report to shareholders, Border Airlines Inc. presented the following balance sheet information about its liabilities:  In addition, Border presented the following among its note disclosures:

In addition, Border presented the following among its note disclosures:

Maturities of long-term debt (including sinking fund requirements) for the next five years are: 2014 - $421 million; 2015 - $212 million; 2016 - $273 million; 2017 - $1.0 billion; 2018 - $777 million.

Required:

Consider the appropriate classification of these long-term debt obligations. Assuming no more long-term debt will be issued, what are the implications of the information above for Border's liquidity and solvency risk in 2013 and the following years?

Correct Answer:

Verified

Because some of the debt is being reclas...View Answer

Unlock this answer now

Get Access to more Verified Answers free of charge

Correct Answer:

Verified

View Answer

Unlock this answer now

Get Access to more Verified Answers free of charge

Q37: Diversified Industries sells perishable electronic products. Some

Q39: Captain Cook Cereal includes one coupon in

Q41: On May 1, Lectric Industries issued 9-month

Q43: Texon Oil is being sued for price

Q43: MullerB Company's employees earn vacation time at

Q44: Albertson Corporation began a special promotion in

Q47: Z Co. filed suit against W Inc.

Q115: The concept of substance over form influences

Q116: Short-term obligations can be reported as long-term

Q127: Financial statement note disclosure is required for