Multiple Choice

An asset acquired January 1, 2013, for $15,000 with an estimated 10-year life and no residual value is being depreciated in an equipment group asset account that has an average service life of eight years. The asset is sold on December 31, 2014, for $6,000. The entry to record the sale would be:

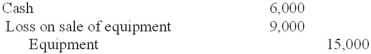

A)

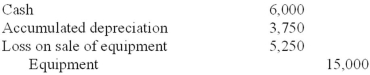

B)

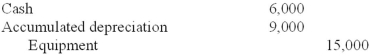

C)

D)

Correct Answer:

Verified

Correct Answer:

Verified

Q37: On September 30, 2013, Morgan, Inc. acquired

Q38: Which of the following types of subsequent

Q40: 2013 amortization: $3,000,000 ÷ 10 = $300,000

Q41: Jennings Advertising Inc. reported the following in

Q43: An impairment loss is indicated because the

Q44: Depreciation for 2013, using double-declining balance, would

Q45: According to International Financial Reporting Standards, the

Q46: Using the straight-line method, depreciation for 2013

Q47: Broadway Ltd. purchased equipment on January 1,

Q129: By the replacement depreciation method, depreciation is