Multiple Choice

On January 1, 2011, Al's Sporting Goods purchased store fixtures at a cost of $180,000. The anticipated service life was 10 years with no residual value. Al's has been using the double-declining balance method, but in 2013 adopted the straight-line method because the company believes it provides a better measure of income. Al's has a December 31 year-end. The journal entry to record depreciation for 2013 is:

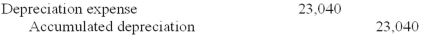

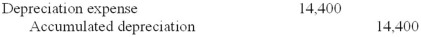

A)

B)

C)

D)

Correct Answer:

Verified

Correct Answer:

Verified

Q34: In 2017, Dooling Corporation acquired Oxford Inc.

Q118: An asset should be written down if

Q136: Asset C3PO has a depreciable base of

Q137: Required:<br>Compute depreciation for 2013 and 2014 and

Q139: Using the straight-line method, depreciation for 2014

Q140: Accounting for impairment losses:<br>A)Involves a two-step process

Q142: The physical life of a depreciable asset

Q143: Gulf Consulting Co. reported the following on

Q145: Canliss Mining uses the retirement method to

Q146: Required:<br>Compute depreciation for 2013 and 2014 and