Multiple Choice

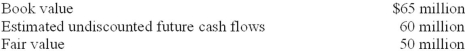

At the end of its 2013 fiscal year, a triggering event caused Janero Corporation to perform an impairment test for one of its manufacturing facilities. The following information is available:  The manufacturing facility is:

The manufacturing facility is:

A) Impaired because its book value exceeds undiscounted future cash flows.

B) Not impaired because its book value exceeds undiscounted future cash flows.

C) Not impaired because it continues to produce revenue.

D) Impaired because its book value exceeds fair value.

Correct Answer:

Verified

Correct Answer:

Verified

Q114: In 2012, Antle Inc. had acquired Demski

Q115: Impairment loss is the difference between book

Q117: The loss would appear in the income

Q118: Prego would report depreciation in 2014 of:<br>A)$135,230.<br>B)$126,000.<br>C)$108,000.<br>D)$105,000.

Q120: An impairment loss is indicated because the

Q121: Using the sum-of-the years'-digits method, depreciation for

Q122: Using the double-declining balance method, depreciation for

Q123: Entry to record the impairment loss:

Q124: Using the straight-line method, depreciation for 2014

Q176: Once selected for existing assets, a company