Multiple Choice

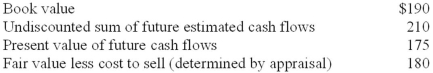

Rice Industries owns a manufacturing plant in a foreign country. Political unrest in the country indicates that Rice should investigate for possible impairment. Below is information related to the plant's assets ($ in millions) :  The amount of impairment loss that Rice should recognize according to U.S. GAAP and IFRS, respectively, is:

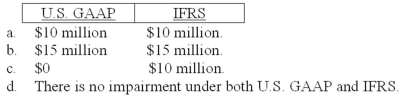

The amount of impairment loss that Rice should recognize according to U.S. GAAP and IFRS, respectively, is:

A) Option a

B) Option b

C) Option c

D) Option d

Correct Answer:

Verified

Correct Answer:

Verified

Q5: Briefly explain the following statement. Depreciation is

Q6: Briefly discuss why straight-line is the most

Q14: Gains on the cash sales of fixed

Q46: Accounting for a change in the estimated

Q54: Because the book value of the net

Q55: Biological assets are valued at fair value

Q58: 2011 amortization: $4,000,000 ÷ 8 = $500,000

Q61: A change in the estimated useful life

Q63: Compute depreciation for 2013 and 2014 and

Q82: Any method of depreciation should be both