Multiple Choice

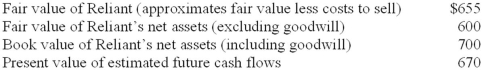

Kingston Corporation has $95 million of goodwill on its books from the 2011 acquisition of Reliant Motors. At the end of its 2013 fiscal year, management has provided the following information for its required goodwill impairment test ($ in millions) :  Assuming that Reliant is considered a reporting unit for U.S. GAAP and a cash-generating unit for IFRS, the amount of goodwill impairment loss that Kingston should recognize according to U.S. GAAP and IFRS, respectively, is:

Assuming that Reliant is considered a reporting unit for U.S. GAAP and a cash-generating unit for IFRS, the amount of goodwill impairment loss that Kingston should recognize according to U.S. GAAP and IFRS, respectively, is:

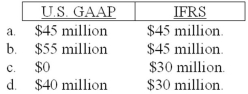

A) Option a

B) Option b

C) Option c

D) Option d

Correct Answer:

Verified

Correct Answer:

Verified

Q20: El Dorado Foods Inc. owns a chain

Q76: Ellen's Antiques reported the following in its

Q77: Eckland Manufacturing Co. purchased equipment on January

Q78: Fellingham Corporation purchased equipment on January 1,

Q82: Required:<br>Compute depreciation for 2013 and 2014 and

Q83: In December of 2013, XL Computer's internal

Q84: Depreciation for 2013, using the straight-line method

Q86: Required:<br>Compute depreciation for 2013 and 2014 and

Q165: Recognition of impairment for property, plant, and

Q222: Statutory depletion is the maximum amount of