Multiple Choice

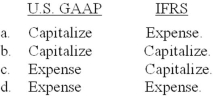

The normal treatment of litigation costs to successfully defend an intangible right under U.S. GAAP and International Financial Reporting Standards (IFRS) , respectively, is:

A) Option a

B) Option b

C) Option c

D) Option d

Correct Answer:

Verified

Correct Answer:

Verified

Q92: Using the sum-of-the-years'-digits method, depreciation for 2013

Q93: On June 30, 2011, Mobley Corporation acquired

Q94: Nature Power Company uses the composite method

Q96: Depreciation (to the nearest dollar) for 2013,

Q98: Briefly explain how to account for a

Q98: Component depreciation, required under International Financial Reporting

Q99: Belotti would record depletion in 2014 of:<br>A)$54,667.<br>B)$65,600.<br>C)$52,480.<br>D)$55,760.

Q100: Using the double-declining balance method, depreciation for

Q101: Robertson Inc. prepares its financial statements according

Q115: Activity-based methods of depreciation are appropriate for