Essay

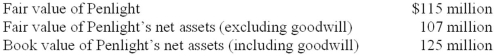

In 2011, Quasar Ltd. acquired all of the common stock of Penlight Laser for $124 million. The fair value of Penlight's identifiable tangible and intangible assets totaled $205 million, and the fair value of liabilities assumed by Quasar was $95 million. Quasar performed a required goodwill impairment test at the end of its fiscal year ended December 31, 2013. Management has provided the following information:  Required:

Required:

1. Determine the amount of goodwill that resulted from the Penlight acquisition.

2. Determine the amount of goodwill impairment loss that Quasar should recognize at the end of 2013, if any.

3. If an impairment loss is required, prepare the journal entry to record the loss.

Correct Answer:

Verified

Correct Answer:

Verified

Q77: A change in the estimated recoverable units

Q104: Using the double-declining balance method, depreciation for

Q105: Calloway Shoes purchased a delivery truck on

Q108: Depreciation (to the nearest dollar) for 2014,

Q110: Using the double-declining balance method, depreciation for

Q111: Compute depreciation for 2013 and 2014 and

Q112: Wilson Inc. owns equipment for which it

Q113: Depreciation, depletion, and amortization:<br>A)All refer to the

Q114: In 2012, Antle Inc. had acquired Demski

Q175: Briefly discuss the factors that determine the