Essay

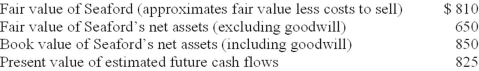

Kentfield Corporation has $260 million of goodwill on its book from the 2010 acquisition of Seaford Shipping. At the end of its 2013 fiscal year, management has provided the following information for a required goodwill impairment test ($ in millions):  Required:

Required:

Assuming that Seaford is considered a reporting unit for U.S. GAAP and a cash-generating unit for IFRS, determine the amount of goodwill impairment loss that Kentfield should recognize according to U.S. GAAP and International Financial Reporting Standards.

Correct Answer:

Verified

U.S. GAAP: Since the book value of Seafo...View Answer

Unlock this answer now

Get Access to more Verified Answers free of charge

Correct Answer:

Verified

View Answer

Unlock this answer now

Get Access to more Verified Answers free of charge

Q1: Belotti would record depletion in 2013 of:<br>A)$41,000.<br>B)$32,800.<br>C)$30,750.<br>D)$24,600.

Q3: Granite Enterprises acquired a patent from Southern

Q6: Depreciation for 2013: $350,000 ÷ 7 =

Q7: Prego would report depreciation in 2013 of:<br>A)$36,000.<br>B)$43,900.<br>C)$18,000.<br>D)$21,950.

Q8: Nanki Corporation purchased equipment on January 1,

Q9: According to International Financial Reporting Standards, the

Q10: Using the straight-line method, the book value

Q11: A change from the straight-line method to

Q19: Assuming an asset is used evenly over

Q73: Changes in the estimates involved in depreciation,