Essay

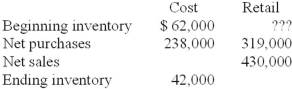

Trask Inc. uses the average cost retail method to estimate its ending inventory. Partial information at June 30, 2013, is as follows:  Required:

Required:

Assuming Trask's cost-to-retail = 60%, compute Trask's beginning inventory at retail.

Correct Answer:

Verified

Correct Answer:

Verified

Q38: In applying the LCM rule, the inventory

Q39: Determine the balance sheet inventory carrying value

Q40: Cornhusker Can Co. uses the conventional retail

Q41: The purpose of ceilings and floors in

Q44: Haskell Corporation. has determined its year-end inventory

Q45: In the year 2013, the internal auditors

Q48: Inventory written down due to LCM may

Q54: International Financial Reporting Standards allow the reversal

Q81: The gross profit method and retail method

Q87: Under the LIFO retail method, which of