Essay

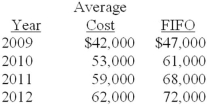

Orlando Company has used the average cost method for inventory valuation since it began business in 2009, but has elected to change to the FIFO method starting in 2012. Year-end inventory valuations under each method are shown below:  Required:

Required:

How would Orlando reflect the change in accounting principle in its financial statements (ignore income taxes)?

Correct Answer:

Verified

Orlando would revise prior years' financ...View Answer

Unlock this answer now

Get Access to more Verified Answers free of charge

Correct Answer:

Verified

View Answer

Unlock this answer now

Get Access to more Verified Answers free of charge

Q19: Billingsly Products uses the conventional retail method

Q20: To the nearest thousand, the estimated ending

Q21: Estimated ending inventory at cost is:<br>A)$90,720.<br>B)$83,500.<br>C)$91,600.<br>D)None of

Q22: The following disclosure note appeared in the

Q26: Under International Financial Reporting Standards, inventory is

Q27: Briefly explain how a material adjustment to

Q28: New York Sales Inc. uses the conventional

Q38: Under the LIFO retail method, the current

Q48: Under the LIFO retail method, the denominator

Q68: Under the conventional retail method, which of