Essay

The following information comes from the 2010 Occidental Petroleum Corporation annual report to shareholders:

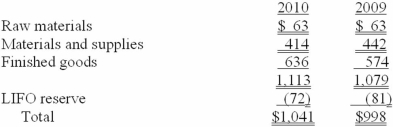

NOTE 4 INVENTORIES

Net carrying values of inventories valued under the LIFO method were approximately $177 million and $175 million at December 31, 2010 and 2009, respectively. Inventories in continuing operations consisted of the following: ($ in millions)  The LIFO reserve indicates that inventories would have been $72 million and $81 million higher at the end of 2010 and 2009, respectively, if Occidental Petroleum had used FIFO to value its entire inventory.

The LIFO reserve indicates that inventories would have been $72 million and $81 million higher at the end of 2010 and 2009, respectively, if Occidental Petroleum had used FIFO to value its entire inventory.

Required:

If Occidental Petroleum had used FIFO to value its entire inventory how would its 2010 pre-tax income be affected?

Correct Answer:

Verified

Cost of goods sold for 2010 would have b...View Answer

Unlock this answer now

Get Access to more Verified Answers free of charge

Correct Answer:

Verified

View Answer

Unlock this answer now

Get Access to more Verified Answers free of charge

Q18: ATC's inventory turnover ratio for 2013 is:<br>A)2.42.<br>B)2.76.<br>C)3.21.<br>D)None

Q24: The inventory method that will always produce

Q35: What is cost of goods available for

Q79: What is Nueva's net income if it

Q97: Dollar-value LIFO eliminates the risk of LIFO

Q107: Inventory does not include:<br>A) Materials used in

Q120: When reported in financial statements, a LIFO

Q170: Compared to dollar-value LIFO, unit LIFO is:<br>A)

Q174: In a perpetual inventory system, the cost

Q182: In a perpetual inventory system, the cost