Essay

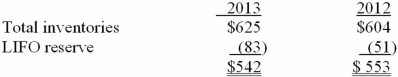

Spando Apparel uses the LIFO inventory method for external reporting and for income tax purposes but maintains its internal records using FIFO. The following disclosure note was included in a recent annual report:

Inventories ($ in millions):  The company's income statement reported cost of goods sold of $3,120 million for the fiscal year ended December 31, 2013.

The company's income statement reported cost of goods sold of $3,120 million for the fiscal year ended December 31, 2013.

Required:

1. Spando adjusts the LIFO reserve at the end of its fiscal year. Prepare the December 31, 2013, adjusting entry to record the cost of goods sold adjustment.

2. If Spando had used FIFO to value its inventories, what would cost of goods sold have been for the 2013 fiscal year?

Correct Answer:

Verified

Correct Answer:

Verified

Q29: Briefly explain the advantages of dollar-value LIFO

Q44: Bettencourt Clothing Corporation uses a periodic inventory

Q48: Ramen Inc. adopted dollar-value LIFO (DVL) as

Q48: Unit LIFO is more costly to implement

Q50: A company that prepares its financial statements

Q53: Cost of goods sold is given by:<br>A)

Q54: Meteor Co. purchased merchandise on March 4,

Q63: The ending inventory under a periodic inventory

Q106: The ending inventory assuming FIFO is:<br>A)$5,140.<br>B)$5,080.<br>C)$5,060.<br>D)$5,050.

Q139: Briefly describe why companies that use perpetual