Essay

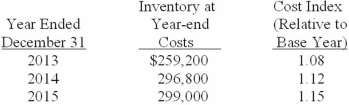

On January 1, 2013, the National Furniture Company adopted the dollar-value LIFO method of computing inventory. An internal cost index is used to convert ending inventory to base year. Inventory on January 1 was $200,000. Year-end inventories at year-end costs and cost indexes for its one inventory pool were as follows:  Required:

Required:

Compute inventory amounts at the end of each year.

Correct Answer:

Verified

Correct Answer:

Verified

Q1: Company C is identical to Company D

Q2: Ending inventory is equal to the cost

Q3: During periods of falling prices, LIFO ending

Q4: The average days inventory for ATC (rounded)

Q35: In a periodic inventory system, the cost

Q68: Ending inventory using the FIFO method is:<br>A)$

Q86: Dollar-value LIFO:<br>A)Starts with ending inventory measured at

Q86: Shipping charges on outgoing goods are included

Q135: Under the gross method, purchase discounts taken

Q136: The use of LIFO during a long