Essay

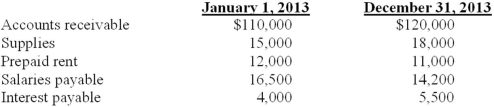

Claymore Corporation maintains its book on a cash basis. During 2013, the company collected $825,000 in fees from its clients and paid $512,000 in expenses. You are able to determine the following information about accounts receivable, supplies, prepaid rent, salaries payable, and interest payable:  In addition, 2013 depreciation expense on office equipment and furniture is $55,000.

In addition, 2013 depreciation expense on office equipment and furniture is $55,000.

Required:

Determine accrual basis income for 2013.

Correct Answer:

Verified

Correct Answer:

Verified

Q46: Davis Hardware Company uses a perpetual inventory

Q50: The adjusting entry required when amounts previously

Q51: Mama's Pizza Shoppe borrowed $8,000 at 9%

Q52: Which of the following is not an

Q53: When a magazine company collects cash for

Q54: What is the purpose of the closing

Q74: Use the following to answer questions <br>

Q100: The statement of cash flows summarizes transactions

Q117: The balance sheet can be considered a

Q123: Prepayments occur when:<br>A) Cash flow precedes expense