Essay

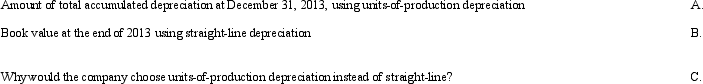

Battery Corp.purchased equipment with a cost of $70,000 at the beginning of 2013.The equipment has an estimated life of 25 years or 25,000 units of product.The estimated residual value is $7,500.During 2013,1,100 units of product were produced with this machinery.Determine the following:

Correct Answer:

Verified

Correct Answer:

Verified

Q25: Interest is capitalized on all purchased assets.

Q43: Creighton, Inc.determined that it had incorrectly estimated

Q64: Explain how the costs associated with operating

Q73: For each of the following sentences 11-14,select

Q78: Royal Company purchased a dump truck at

Q79: What is the relationship between the depreciation

Q80: Duggard Transport Company On January 1,2013,Duggard Transport

Q140: Darrin Brown bought a pub.The purchase price

Q154: All of the following are included in

Q199: All of the following are intangible assets