Essay

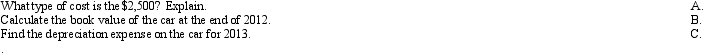

Glidewell Company purchased a car for a salesman for $23,500 at the beginning of 2012.The car had an estimated life of 5 years,and an estimated residual value of $3,500.Glidewell used the straight-line depreciation method.At the beginning of 2013,Glidewell incurred $2,500 to replace the car's transmission.This resulted in a 2-year extension of the car's useful life,but no change in the residual value.

Correct Answer:

Verified

Correct Answer:

Verified

Q5: Braggert,Inc.purchased a truck at the beginning of

Q7: Wen's Export Co. Wen's Export Co.purchased a

Q9: If a company constructs an asset over

Q10: Blanton Company bought equipment on January 1,2012

Q11: Assume that Deane Company purchased factory equipment

Q13: Sharp purchased equipment at the beginning of

Q30: How should intangible assets be disclosed on

Q84: Costs incurred related to plant assets that

Q159: Because plant and equipment are reported as

Q210: Eagle's Nest sold equipment for $4,000 cash.