Multiple Choice

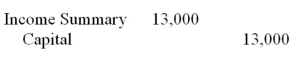

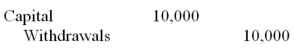

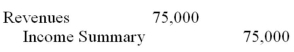

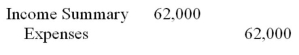

A company had revenues of $75,000,withdrawals of $10,000 and expenses of $62,000 during an accounting period.Which of the following entries should not be journalized in the closing process?

A)

B)

C)

D)

E) All of these should be journalized in the closing process.

Correct Answer:

Verified

Correct Answer:

Verified

Q9: Calculate the current ratio in each of

Q11: FastForward's post-closing trial balance has a debit

Q12: Accounts that are used to describe revenues,expenses,and

Q14: The adjusted trial balance of Richardson Electric

Q17: If,in preparing a work sheet,an adjusted trial

Q34: Harley Ravidson's current assets are $400 million

Q73: The accounting cycle refers to the steps

Q81: The Unadjusted Trial Balance columns of the

Q108: Current assets and current liabilities are expected

Q128: Which statement is incorrect?<br>A) Revenue accounts are