Multiple Choice

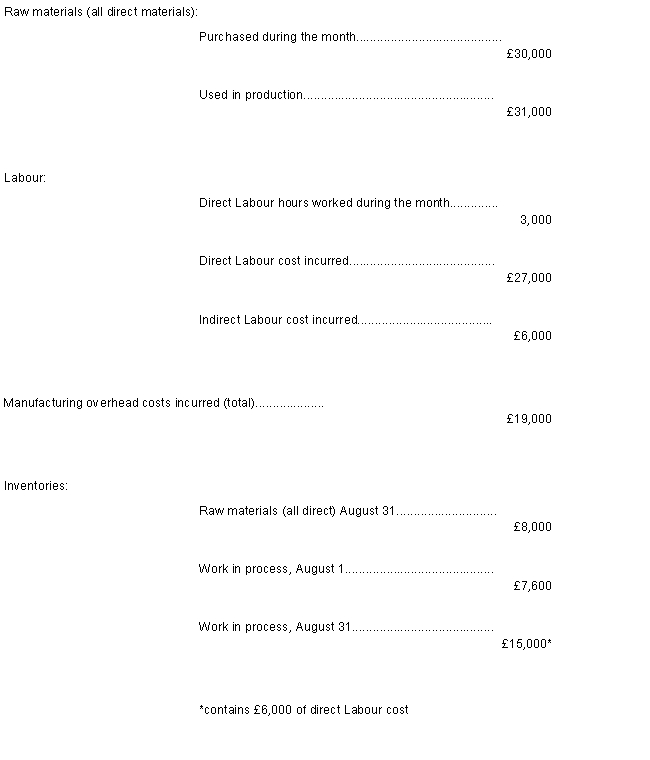

Loraine Company applies manufacturing overhead to jobs using a predetermined overhead rate of 70% of direct Labour cost. Any under- or overapplied overhead cost is closed to Cost of Goods Sold at the end of the month. During August, the following transactions were recorded by the company:

-The entry to dispose of the under- or overapplied overhead cost for the month would include:

A) a credit of £100 to Cost of Goods Sold.

B) a credit of £6,000 to Manufacturing Overhead.

C) a debit of £6,000 to Cost of Goods Sold.

D) A credit of £100 to the Manufacturing Overhead Account.

Correct Answer:

Verified

Correct Answer:

Verified

Q46: Which of the following would probably be

Q47: Newcastle Company's beginning and ending inventories

Q48: In computing its predetermined overhead rate, Brady

Q49: Under- or overapplied overhead represents the difference

Q50: The use of predetermined overhead rates in

Q52: In a job order cost system, the

Q53: The balance in the Work in Process

Q54: Entry Effect on Cost ofGoods Sold<br>a.<br><br><br>

Q55: In a job-order cost system, the application

Q56: Period costs are expensed as incurred, rather