Multiple Choice

The International Company makes and sells only one product. There are 2 divisions, one in France and one in Newcastle.

The company is in the process of preparing its Selling and Administrative Expense Budget for the last half of the year. The following budget data are available:

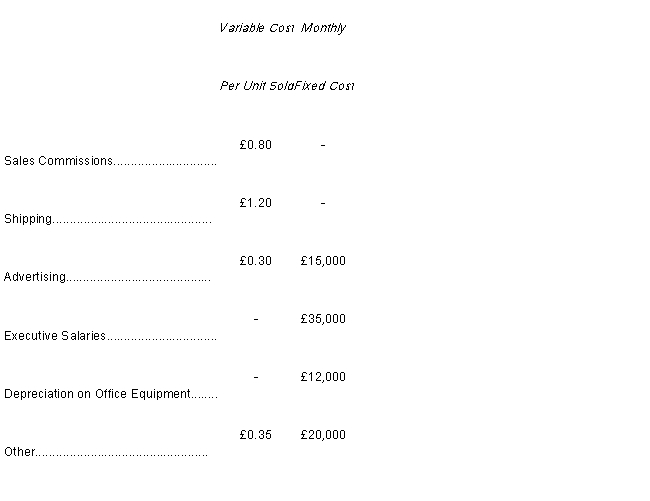

French Division Cost Structure

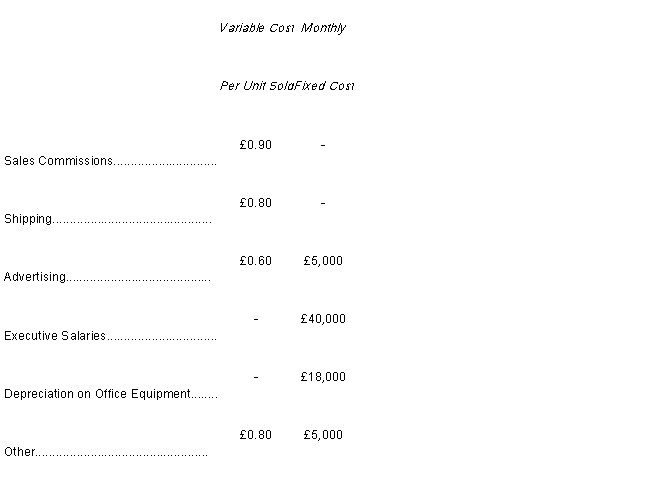

Newcastle Division Cost Structure

- All of these expenses (except depreciation) are paid in cash in the month they are incurred. If the Newcastle Division has budgeted to sell 24,000 units in September, then the total budgeted fixed selling and administrative expenses for September would be

A) £69,600.

B) £58,000.

C) £70,000.

D) £68,000.

Correct Answer:

Verified

Correct Answer:

Verified

Q15: One difficulty with self-imposed budgets is that

Q16: Shown below is the sales forecast

Q17: The Adams Company, a merchandising firm,

Q18: Both variable and fixed manufacturing overhead costs

Q19: <span class="ql-formula" data-value="\begin{array}{lrr}&\text { Cash Sales }

Q21: The Jung Corporation's production budget calls

Q22: The International Company makes and sells only

Q23: The Adams Company, a merchandising firm,

Q25: Super Drive is a computer hard

Q28: "I can't see the point of budgeting.