Multiple Choice

Greenwich plc is considering adding two new products at a subsidiary to improve its overall competitiveness. The new products are enthusiastically supported by the managers responsible and an immediate decision is required. It is normal for the managers to calculate the net present value (NPV) for the projects before it is accepted or rejected.

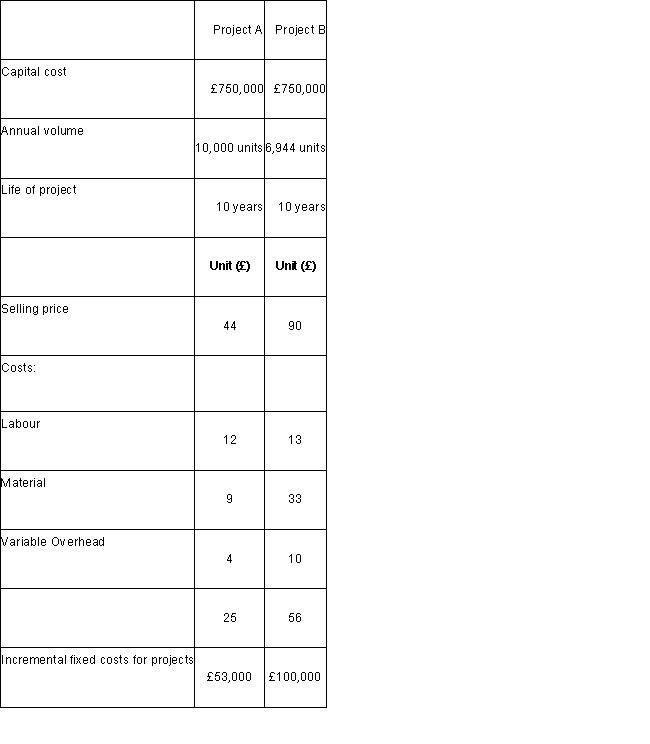

Details of the proposals

-

Calculate the relevant annual cash flow for Project A

A) £190,000.

B) £243,000.

C) £137,000.

D) £84,000.

Correct Answer:

Verified

Correct Answer:

Verified

Q53: (Ignore income taxes in this problem. )Mercredi,Inc.

Q55: The Deta Company is analyzing projects

Q56: Spring Company has invested £20,000 in a

Q57: The after-tax cost of a deductible cash

Q58: Bringing future sums to their present value

Q60: The simple rate of return focuses on

Q61: (Ignore income taxes in this problem.) Two

Q62: (Ignore income taxes in this problem.)

Q63: Discuss the advantages and disadvantages of the

Q64: (Ignore income taxes in this problem.) Cause