Multiple Choice

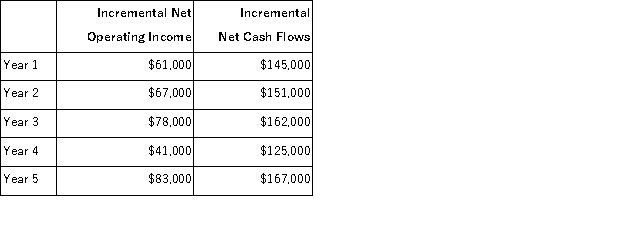

Baldock Inc.is considering the acquisition of a new machine that costs $420,000 and has a useful life of 5 years with no salvage value.The incremental net operating income and incremental net cash flows that would be produced by the machine are:  Assume cash flows occur uniformly throughout a year except for the initial investment. If the discount rate is 12%,the net present value of the investment is closest to:

Assume cash flows occur uniformly throughout a year except for the initial investment. If the discount rate is 12%,the net present value of the investment is closest to:

A) $330,000

B) $539,365

C) $119,365

D) $420,000

Correct Answer:

Verified

Correct Answer:

Verified

Q4: The Gomez Corporation is considering two projects,T

Q7: Correl Corporation has provided the following data

Q13: Juliar Inc.has provided the following data concerning

Q45: In the payback method, depreciation is deducted

Q68: A company with $600,000 in operating assets

Q76: Weilbacher Corporation is considering the purchase of

Q81: Mark Stevens is considering opening a hobby

Q97: The management of Basler Corporation is considering

Q101: Mercer Corporation is considering replacing a technologically

Q128: An investment project with a project profitability