Multiple Choice

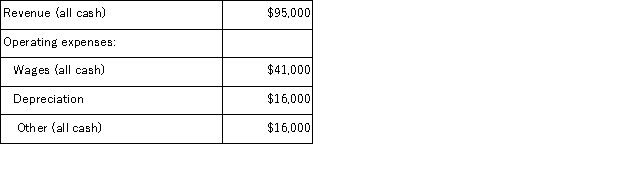

The Halsey Corporation is contemplating the purchase of new equipment that would require an initial investment of $125,000.The equipment would have a useful life of six years,with a salvage value of $29,000.This new equipment would be depreciated over its useful life by the straight-line method.It would replace existing equipment which is fully depreciated.The existing equipment has a salvage value now of $38,000.The anticipated annual revenues and expenses associated with the new equipment are:  Assume cash flows occur uniformly throughout a year except for the initial investment and the salvage value at the end of the project. The payback period is closest to:

Assume cash flows occur uniformly throughout a year except for the initial investment and the salvage value at the end of the project. The payback period is closest to:

A) 5.7 years

B) 4.0 years

C) 2.3 years

D) 1.8 years

Correct Answer:

Verified

Correct Answer:

Verified

Q10: Janes, Inc., is considering the purchase of

Q29: Alesi Corporation is considering purchasing a machine

Q47: If taxes are ignored, all of the

Q54: The management of Mashiah Corporation is considering

Q102: Tangen Corporation is considering the purchase of

Q103: The investment required for the project profitability

Q108: Valotta Corporation has provided the following data

Q114: Dul Corporation has provided the following data

Q115: Chee Corporation has gathered the following data

Q126: The net present value of an investment