Multiple Choice

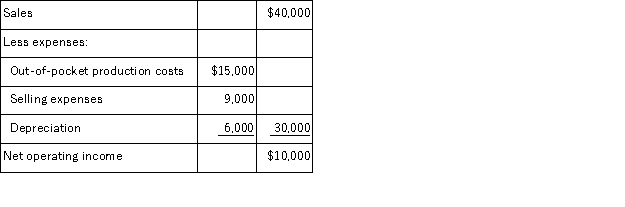

Pro-Mate,Inc.is a producer of athletic equipment.The company is considering the purchase of a machine to produce baseball bats.The machine will cost $60,000 and have a 10-year useful life.The following annual revenues and expenses are projected:  The machine will have no salvage value.Assume cash flows occur uniformly throughout a year except for the initial investment. The payback period for the new machine is about:

The machine will have no salvage value.Assume cash flows occur uniformly throughout a year except for the initial investment. The payback period for the new machine is about:

A) 6.0 years

B) 1.5 years

C) 5.4 years

D) 3.75 years

Correct Answer:

Verified

Correct Answer:

Verified

Q7: The management of Mashiah Corporation is considering

Q12: Naomi Corporation has a capital budgeting project

Q32: The payback method of making capital budgeting

Q48: The management of Stanforth Corporation is investigating

Q61: Fimbrez Corporation has provided the following data

Q61: Dunay Corporation is considering investing $510,000 in

Q62: The simple rate of return method does

Q64: Bowen Corporation is considering several investment proposals,as

Q86: Crowley Corporation is considering three investment projects:

Q121: When discounted cash flow methods of capital