Multiple Choice

Dilbert Farm Supply is located in a small town in the rural west.Data regarding the store's operations follow: o Sales are budgeted at $260,000 for November,$230,000 for December,and $210,000 for January.

O Collections are expected to be 80% in the month of sale,19% in the month following the sale,and 1% uncollectible.

O The cost of goods sold is 65% of sales.

O The company desires to have an ending merchandise inventory at the end of each month equal to 60% of the next month's cost of goods sold.Payment for merchandise is made in the month following the purchase.

O Other monthly expenses to be paid in cash are $20,300.

O Monthly depreciation is $20,000.

O Ignore taxes.  The accounts receivable balance,net of uncollectible accounts,at the end of December would be:

The accounts receivable balance,net of uncollectible accounts,at the end of December would be:

A) $46,000

B) $93,100

C) $43,700

D) $81,300

Correct Answer:

Verified

Correct Answer:

Verified

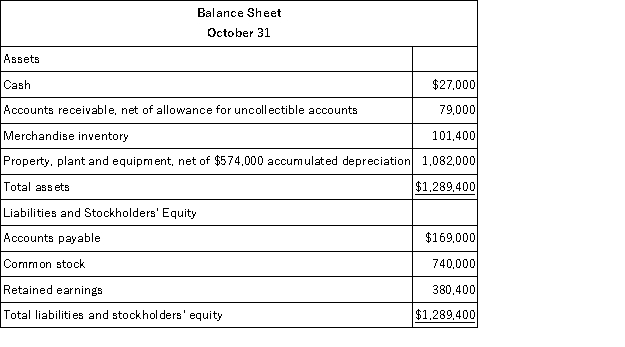

Q74: The Adams Corporation, a merchandising firm, has

Q91: Trumbull Corporation budgeted sales on account of

Q140: The LFG Corporation makes and sells a

Q143: Cowles Corporation Inc. ,makes and sells a

Q144: Bracken Corporation is a small wholesaler of

Q145: Which of the following might be included

Q146: Bracken Corporation is a small wholesaler of

Q149: Clay Corporation has projected sales and production

Q152: The TS Corporation has budgeted sales for

Q153: Triste Corporation manufactures and sells women's skirts.Each