Multiple Choice

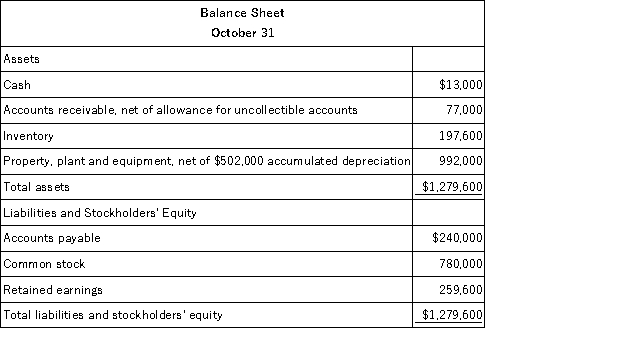

Carter Lumber sells lumber and general building supplies to building contractors in a medium-sized town in Montana.Data regarding the store's operations follow: o Sales are budgeted at $380,000 for November,$390,000 for December,and $400,000 for January.

O Collections are expected to be 70% in the month of sale,27% in the month following the sale,and 3% uncollectible.

O The cost of goods sold is 65% of sales.

O The company desires to have an ending merchandise inventory equal to 80% of the following month's cost of goods sold.Payment for merchandise is made in the month following the purchase.

O Other monthly expenses to be paid in cash are $22,000.

O Monthly depreciation is $20,000.

O Ignore taxes.  The cash balance at the end of December would be:

The cash balance at the end of December would be:

A) $182,400

B) $114,400

C) $13,000

D) $195,400

Correct Answer:

Verified

Correct Answer:

Verified

Q6: The cash budget is usually prepared after

Q64: LFM Corporation makes and sells a product

Q76: When preparing a direct materials budget, the

Q100: Which of the following benefits could an

Q117: Parsons Corporation plans to sell 18,000 units

Q120: The basic idea underlying responsibility accounting is

Q137: Rogers Corporation is preparing its cash budget

Q142: For July, White Corporation has budgeted production

Q156: Davey Corporation is preparing its Manufacturing Overhead

Q161: The direct labor budget shows the direct