Multiple Choice

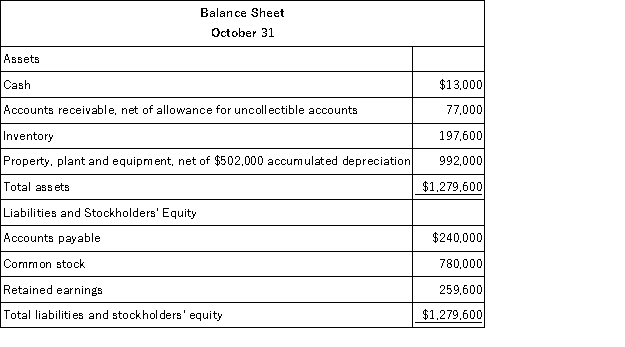

Carter Lumber sells lumber and general building supplies to building contractors in a medium-sized town in Montana.Data regarding the store's operations follow: o Sales are budgeted at $380,000 for November,$390,000 for December,and $400,000 for January.

O Collections are expected to be 70% in the month of sale,27% in the month following the sale,and 3% uncollectible.

O The cost of goods sold is 65% of sales.

O The company desires to have an ending merchandise inventory equal to 80% of the following month's cost of goods sold.Payment for merchandise is made in the month following the purchase.

O Other monthly expenses to be paid in cash are $22,000.

O Monthly depreciation is $20,000.

O Ignore taxes.  Retained earnings at the end of December would be:

Retained earnings at the end of December would be:

A) $259,600

B) $342,400

C) $422,000

D) $445,100

Correct Answer:

Verified

Correct Answer:

Verified

Q21: On a cash budget, the total amount

Q21: Muecke Inc. is working on its cash

Q28: Roberts Corporation manufactures home cleaning products. One

Q32: One disadvantage of a self-imposed budget is

Q116: The following are budgeted data for the

Q117: The following are budgeted data for the

Q118: Noel Enterprises has budgeted sales in units

Q120: Poriss Corporation makes and sells a single

Q122: Weldon Industrial Gas Corporation supplies acetylene and

Q123: The following information is budgeted for McCracken