Multiple Choice

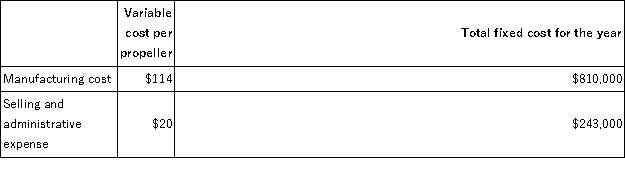

Cutterski Corporation manufactures a propeller.Shown below is Cutterski's cost structure:  In its first year of operations,Cutterski produced 60,000 propellers but only sold 54,000. Which costing method (variable or absorption) will generate a higher net operating income in Cutterski's first year of operations and by how much?

In its first year of operations,Cutterski produced 60,000 propellers but only sold 54,000. Which costing method (variable or absorption) will generate a higher net operating income in Cutterski's first year of operations and by how much?

A) variable by $81,000

B) variable by $108,000

C) absorption by $81,000

D) absorption by $108,000

Correct Answer:

Verified

Correct Answer:

Verified

Q38: Walkenhorst Corporation has two divisions: Bulb Division

Q40: Waltz Corporation has two divisions: Xi and

Q42: Data for March for Lazarus Corporation and

Q44: Sosinski Corporation has two divisions: Domestic Division

Q45: Muhn Corporation has two divisions: Division K

Q46: A manufacturing company that produces a single

Q47: Jarvix Corporation,which has only one product,has provided

Q55: If a company operates at the break

Q114: Under variable costing, product cost does not

Q144: Gunderman Corporation has two divisions: the Alpha