Multiple Choice

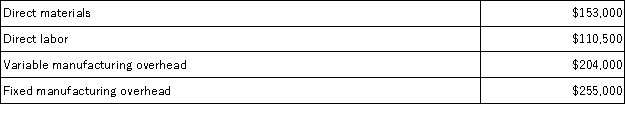

Harris Corporation produces a single product.Last year,Harris manufactured 17,000 units and sold 13,000 units.Production costs for the year were as follows:  Sales were $780,000 for the year,variable selling and administrative expenses were $88,400,and fixed selling and administrative expenses were $170,000.There was no beginning inventory.Assume that direct labor is a variable cost. Under variable costing,the company's net operating income for the year would be:

Sales were $780,000 for the year,variable selling and administrative expenses were $88,400,and fixed selling and administrative expenses were $170,000.There was no beginning inventory.Assume that direct labor is a variable cost. Under variable costing,the company's net operating income for the year would be:

A) $60,000 higher than under absorption costing

B) $108,000 higher than under absorption costing

C) $108,000 lower than under absorption costing

D) $60,000 lower than under absorption costing

Correct Answer:

Verified

Correct Answer:

Verified

Q19: Quinnett Corporation has two divisions: the Export

Q20: Net operating income is affected by the

Q42: Under variable costing, product costs consist of

Q90: If a cost must be arbitrarily allocated

Q195: Kosco Corporation produces a single product.The company's

Q196: Ivancevic Inc. ,which produces a single product,has

Q202: Iancu Corporation,which has only one product,has provided

Q205: Bateman Corporation,which has only one product,has provided

Q207: Sorto Corporation has two divisions: the East

Q212: Swifton Corporation produces a single product. Last