Multiple Choice

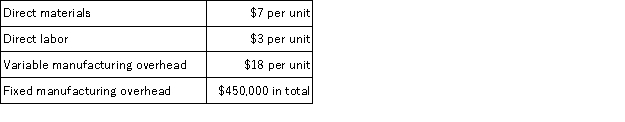

During its first year of operations,Carlos Manufacturing Corporation incurred the following costs to produce 8,000 units of its only product:  The company also incurred the following costs in selling 7,500 units of product during its first year:

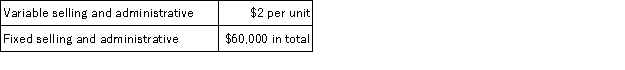

The company also incurred the following costs in selling 7,500 units of product during its first year:  Assume that direct labor is a variable cost. If Carlos' absorption costing net operating income for this first year is $118,125,what would its variable costing net operating income be for this first year?

Assume that direct labor is a variable cost. If Carlos' absorption costing net operating income for this first year is $118,125,what would its variable costing net operating income be for this first year?

A) $86,000

B) $90,000

C) $104,125

D) $146,250

Correct Answer:

Verified

Correct Answer:

Verified

Q118: Which of the following costs at a

Q119: Hanks Corporation produces a single product.Operating data

Q120: Farron Corporation,which has only one product,has provided

Q121: Yankee Corporation manufactures a single product.The company

Q122: Peals Corporation has two divisions: Home Division

Q124: Crystal Corporation produces a single product.The company's

Q125: Crossbow Corp.produces a single product.Data concerning June's

Q126: Keefe Corporation has two divisions: Western Division

Q127: Pevy Corporation has two divisions: Southern Division

Q128: Kadle Corporation has two divisions: Division L