Multiple Choice

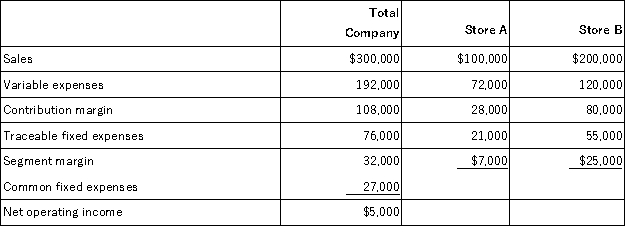

O'Neill,Incorporated's segmented income statement for the most recent month is given below.  For each of the following questions,refer back to the above original data. A proposal has been made that will lower variable expenses in Store A to 62% of sales.However,this reduction can only be accomplished by an increase in Store A's traceable fixed expenses of $8,000.If this proposal is implemented and sales remain constant,overall company net operating income should:

For each of the following questions,refer back to the above original data. A proposal has been made that will lower variable expenses in Store A to 62% of sales.However,this reduction can only be accomplished by an increase in Store A's traceable fixed expenses of $8,000.If this proposal is implemented and sales remain constant,overall company net operating income should:

A) remain the same

B) decrease by $4,200

C) increase by $2,000

D) increase by $8,000

Correct Answer:

Verified

Correct Answer:

Verified

Q79: Zimmerli Corporation manufactures a single product.The following

Q83: Hatfield Corporation,which has only one product,has provided

Q85: Farron Corporation,which has only one product,has provided

Q86: Schweinert Corporation manufactures a single product.The following

Q88: Jimerson Corporation produces a single product and

Q89: Warburton Corporation has two divisions: Alpha and

Q99: When using segmented income statements, the dollar

Q100: Under variable costing, which of the following

Q152: Errera Corporation has two major business segments-Retail

Q215: Under absorption costing, fixed manufacturing overhead cost