Essay

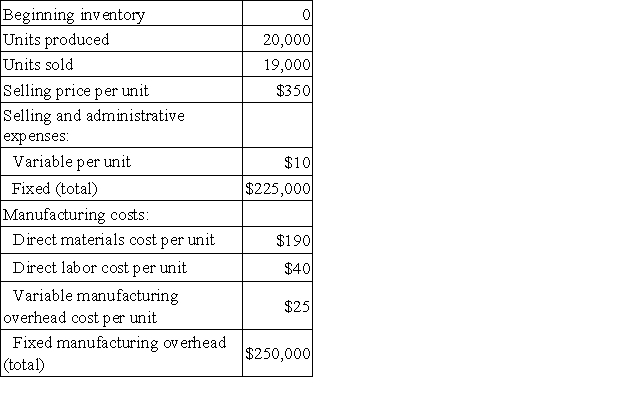

The Dean Corporation produces and sells a single product.The following data refer to the year just completed:  Assume that direct labor is a variable cost.

Assume that direct labor is a variable cost.

Required:

a.Compute the cost of a single unit of product under both the absorption costing and variable costing approaches.

b.Prepare an income statement for the year using absorption costing.

c.Prepare a contribution format income statement for the year using variable costing.

d.Reconcile the absorption costing and variable costing net operating income figures in (b)and (c)above.

Correct Answer:

Verified

a.Cost per unit under absorption costing...View Answer

Unlock this answer now

Get Access to more Verified Answers free of charge

Correct Answer:

Verified

View Answer

Unlock this answer now

Get Access to more Verified Answers free of charge

Q38: When using segmented income statements, the dollar

Q103: Aaker Corporation,which has only one product,has provided

Q104: Yankee Corporation manufactures a single product.The company

Q105: Kosco Corporation produces a single product.The company's

Q109: Nantua Corporation has two divisions,Southern and Northern.The

Q110: A manufacturing company that produces a single

Q111: Bateman Corporation,which has only one product,has provided

Q112: Aaker Corporation,which has only one product,has provided

Q124: When viewed over the long term, cumulative

Q128: Under variable costing, fixed manufacturing overhead is:<br>A)carried