Multiple Choice

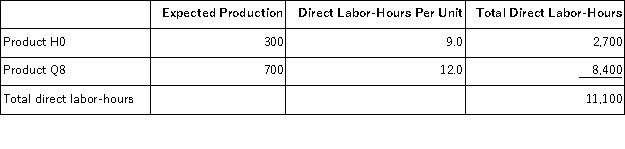

Kamerling,Inc. ,manufactures and sells two products: Product H0 and Product Q8.Data concerning the expected production of each product and the expected total direct labor-hours (DLHs) required to produce that output appear below:  The direct labor rate is $16.50 per DLH.The direct materials cost per unit for each product is given below:

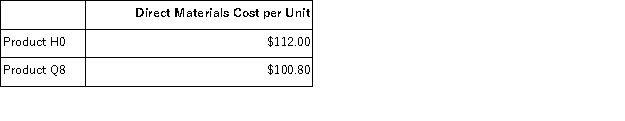

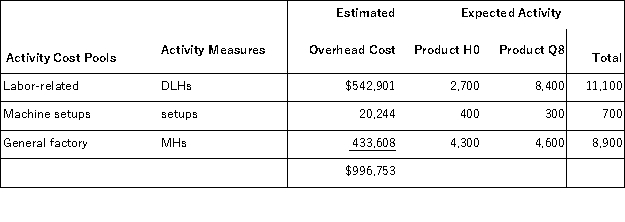

The direct labor rate is $16.50 per DLH.The direct materials cost per unit for each product is given below:  The company has an activity-based costing system with the following activity cost pools,activity measures,and expected activity:

The company has an activity-based costing system with the following activity cost pools,activity measures,and expected activity:  The overhead applied to each unit of Product H0 under activity-based costing is closest to:

The overhead applied to each unit of Product H0 under activity-based costing is closest to:

A) $698.32 per unit

B) $996.75 per unit

C) $808.20 per unit

D) $1,177.07 per unit

Correct Answer:

Verified

Correct Answer:

Verified

Q72: In general, activities and costs should be

Q103: Crazier,Inc. ,manufactures and sells two products: Product

Q104: Stirman,Inc. ,manufactures and sells two products: Product

Q105: Boutet,Inc. ,manufactures and sells two products: Product

Q106: Machuga,Inc. ,manufactures and sells two products: Product

Q107: Mellencamp,Inc. ,manufactures and sells two products: Product

Q109: Boahn,Inc. ,manufactures and sells two products: Product

Q110: Onstad,Inc. ,manufactures and sells two products: Product

Q112: Frogge,Inc. ,manufactures and sells two products: Product

Q113: Masiclat,Inc. ,manufactures and sells two products: Product