Multiple Choice

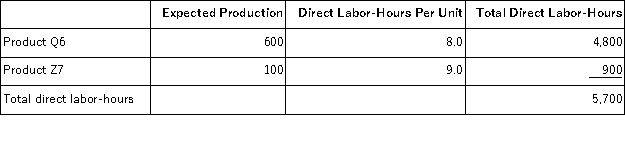

Aboud,Inc. ,manufactures and sells two products: Product Q6 and Product Z7.Data concerning the expected production of each product and the expected total direct labor-hours (DLHs) required to produce that output appear below:  The direct labor rate is $25.90 per DLH.The direct materials cost per unit for each product is given below:

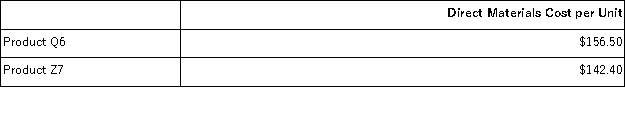

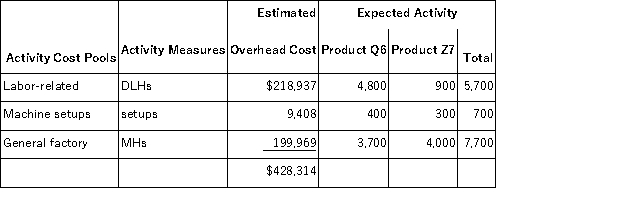

The direct labor rate is $25.90 per DLH.The direct materials cost per unit for each product is given below:  The company has an activity-based costing system with the following activity cost pools,activity measures,and expected activity:

The company has an activity-based costing system with the following activity cost pools,activity measures,and expected activity:  The total overhead applied to Product Q6 under activity-based costing is closest to:

The total overhead applied to Product Q6 under activity-based costing is closest to:

A) $360,672

B) $285,833

C) $96,090

D) $367,128

Correct Answer:

Verified

Correct Answer:

Verified

Q82: When a company changes from a traditional

Q113: In activity-based costing, unit product costs computed

Q147: Marchan,Inc. ,manufactures and sells two products: Product

Q148: Data concerning three of the activity cost

Q149: Swagg Jewelry Corporation manufactures custom jewelry.In the

Q150: Besser,Inc. ,manufactures and sells two products: Product

Q153: Betenbaugh,Inc. ,manufactures and sells two products: Product

Q154: Dunnivan,Inc. ,manufactures and sells two products: Product

Q156: Mcleese,Inc. ,manufactures and sells two products: Product

Q186: In activity-based costing, unit product costs computed