Multiple Choice

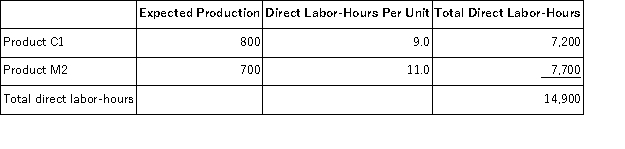

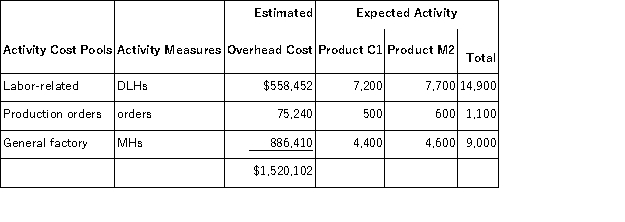

Machuga,Inc. ,manufactures and sells two products: Product C1 and Product M2.Data concerning the expected production of each product and the expected total direct labor-hours (DLHs) required to produce that output appear below:  The direct labor rate is $18.70 per DLH.The direct materials cost per unit is $297.00 for Product C1 and $246.20 for Product M2. The company is considering adopting an activity-based costing system with the following activity cost pools,activity measures,and expected activity:

The direct labor rate is $18.70 per DLH.The direct materials cost per unit is $297.00 for Product C1 and $246.20 for Product M2. The company is considering adopting an activity-based costing system with the following activity cost pools,activity measures,and expected activity:  The overhead applied to each unit of Product C1 under activity-based costing is closest to:

The overhead applied to each unit of Product C1 under activity-based costing is closest to:

A) $918.18 per unit

B) $541.70 per unit

C) $1,013.40 per unit

D) $921.77 per unit

Correct Answer:

Verified

Correct Answer:

Verified

Q16: Which of the following would be classified

Q38: Facility-level activities are activities that are carried

Q84: Activities consume resources. In activity-based costing an

Q126: Companies use three common approaches to assign

Q172: Frogge,Inc. ,manufactures and sells two products: Product

Q173: Paolello,Inc. ,manufactures and sells two products: Product

Q176: Mellencamp,Inc. ,manufactures and sells two products: Product

Q177: Rosman,Inc. ,manufactures and sells two products: Product

Q179: Serva,Inc. ,manufactures and sells two products: Product

Q180: Mouret Corporation uses the following activity rates