Essay

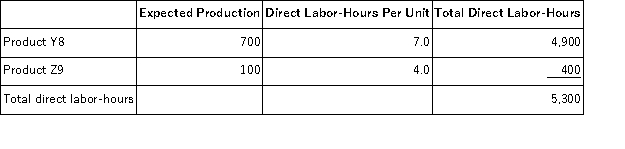

Moul,Inc. ,manufactures and sells two products: Product Y8 and Product Z9.Data concerning the expected production of each product and the expected total direct labor-hours (DLHs)required to produce that output appear below:  The direct labor rate is $18.80 per DLH.The direct materials cost per unit is $116.30 for Product Y8 and $187.40 for Product Z9.

The direct labor rate is $18.80 per DLH.The direct materials cost per unit is $116.30 for Product Y8 and $187.40 for Product Z9.

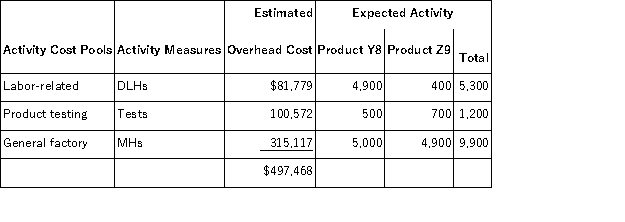

The company has an activity-based costing system with the following activity cost pools,activity measures,and expected activity:  Required:

Required:

In all computations involving dollars in the following requirements,round off your answer to the nearest whole cent.

a.Compute the activity rates under the activity-based costing system.

b.Determine how much overhead would be assigned to each product under the activity-based costing system.

c.Determine the unit product cost of each product under the activity-based costing method.

Correct Answer:

Verified

Computation of activity rates:...View Answer

Unlock this answer now

Get Access to more Verified Answers free of charge

Correct Answer:

Verified

View Answer

Unlock this answer now

Get Access to more Verified Answers free of charge

Q11: Activity rates in activity-based costing are computed

Q65: Serva,Inc. ,manufactures and sells two products: Product

Q66: Dunnivan,Inc. ,manufactures and sells two products: Product

Q67: Dobles Corporation has provided the following data

Q68: Scarff,Inc. ,manufactures and sells two products: Product

Q71: Angara Corporation uses activity-based costing to determine

Q72: Millner Corporation has provided the following data

Q73: Masiclat,Inc. ,manufactures and sells two products: Product

Q75: Pachero,Inc. ,manufactures and sells two products: Product

Q187: An activity measure in activity-based costing expresses