Multiple Choice

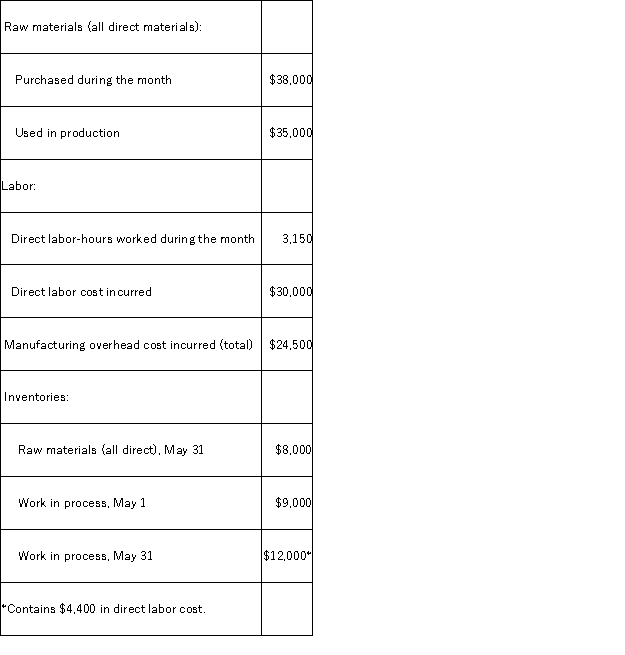

Dillon Corporation applies manufacturing overhead to jobs using a predetermined overhead rate of 75% of direct labor cost.Any under or overapplied manufacturing overhead cost is closed out to Cost of Goods Sold at the end of the month.During May,the following transactions were recorded by the company:  The entry to dispose of the under or overapplied manufacturing overhead cost for the month would include:

The entry to dispose of the under or overapplied manufacturing overhead cost for the month would include:

A) a debit of $2,000 to the Manufacturing Overhead account.

B) a credit of $2,500 to the Manufacturing Overhead account.

C) a debit of $2,000 to Cost of Goods Sold.

D) a credit of $2,500 to Cost of Goods SolD.Overhead over or underapplied

Correct Answer:

Verified

Correct Answer:

Verified

Q11: The following T-accounts have been constructed from

Q13: Acton Corporation,which applies manufacturing overhead on the

Q17: The following partially completed T-accounts summarize transactions

Q20: Jameson Corporation uses a predetermined overhead rate

Q22: Killian Corporation began operations on January 1.

Q26: In a job-order costing system, the use

Q61: Donham Corporation had $25,000 of raw materials

Q86: In computing its predetermined overhead rate, Brady

Q114: Echo Corporation uses a job-order costing system

Q160: Alden Company recorded the following transactions for