Multiple Choice

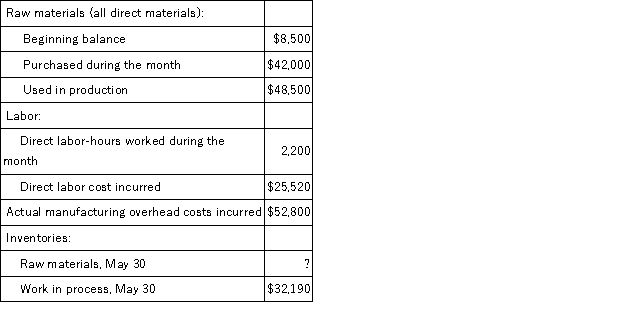

Dapper Corporation had only one job in process on May 1.The job had been charged with $3,400 of direct materials,$4,640 of direct labor,and $9,200 of manufacturing overhead cost.The company assigns overhead cost to jobs using the predetermined overhead rate of $23.00 per direct labor-hour. During May,the following activity was recorded:  Work in process inventory on May 30 contains $7,540 of direct labor cost.Raw materials consist solely of items that are classified as direct materials.

Work in process inventory on May 30 contains $7,540 of direct labor cost.Raw materials consist solely of items that are classified as direct materials.

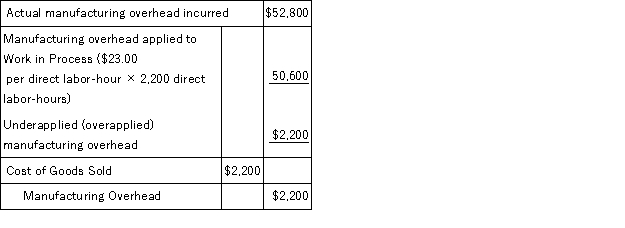

The entry to dispose of the underapplied or overapplied manufacturing overhead cost for the month would include a:

A) debit of $2,200 to Manufacturing Overhead.

B) debit of $14,950 to Manufacturing Overhead.

C) credit of $14,950 to Manufacturing Overhead.

D) credit of $2,200 to Manufacturing OverheaD.

Correct Answer:

Verified

Correct Answer:

Verified

Q5: The following accounts are from last year's

Q10: The following partially completed T-accounts summarize transactions

Q11: The following T-accounts have been constructed from

Q13: Acton Corporation,which applies manufacturing overhead on the

Q26: In a job-order costing system, the use

Q27: Soledad Corporation had $36,000 of raw materials

Q56: Traves Corporation incurred $69,000 of actual Manufacturing

Q61: Donham Corporation had $25,000 of raw materials

Q117: If direct labor-hours is used as the

Q144: On March 1, Metevier Corporation had $37,000