Essay

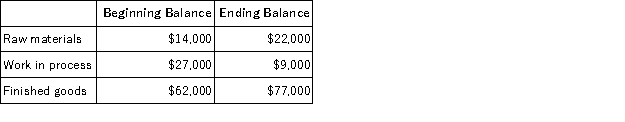

Bakerston Company is a manufacturing firm that uses job-order costing.The company's inventory balances were as follows at the beginning and end of the year:  The company applies overhead to jobs using a predetermined overhead rate based on machine-hours.At the beginning of the year,the company estimated that it would work 33,000 machine-hours and incur $231,000 in manufacturing overhead cost.The following transactions were recorded for the year:

The company applies overhead to jobs using a predetermined overhead rate based on machine-hours.At the beginning of the year,the company estimated that it would work 33,000 machine-hours and incur $231,000 in manufacturing overhead cost.The following transactions were recorded for the year:

• Raw materials were purchased,$315,000.

• Raw materials were requisitioned for use in production,$307,000 ($281,000 direct and $26,000 indirect).

• The following employee costs were incurred: direct labor,$377,000;indirect labor,$96,000;and administrative salaries,$172,000.

• Selling costs,$147,000.

• Factory utility costs,$10,000.

• Depreciation for the year was $127,000 of which $120,000 is related to factory operations and $7,000 is related to selling,general,and administrative activities.

• Manufacturing overhead was applied to jobs.The actual level of activity for the year was 34,000 machine-hours.

• Sales for the year totaled $1,253,000.

Required:

a.Prepare a schedule of cost of goods manufactured.

b.Was the overhead underapplied or overapplied? By how much?

c.Prepare an income statement for the year.The company closes any underapplied or overapplied overhead to Cost of Goods Sold.

Correct Answer:

Verified

a.Schedule of cost of goods ma...View Answer

Unlock this answer now

Get Access to more Verified Answers free of charge

Correct Answer:

Verified

View Answer

Unlock this answer now

Get Access to more Verified Answers free of charge

Q10: At the beginning of December, Sneeden Corporation

Q46: In a job-order cost system, direct labor

Q71: Job 231 was recently completed.The following data

Q73: Collins Corporation uses a predetermined overhead rate

Q75: Dapper Corporation had only one job in

Q81: Tondre Inc.has provided the following data for

Q91: When the predetermined overhead rate is based

Q110: The sum of all amounts transferred from

Q122: Baker Corporation applies manufacturing overhead on the

Q129: Sirmons Corporation bases its predetermined overhead rate