Essay

The Commonwealth Company uses a job-order costing system and applies manufacturing overhead cost to jobs using a predetermined overhead rate based on the cost of materials used in production.At the beginning of the year,the following estimates were made as a basis for computing the predetermined overhead rate: manufacturing overhead cost,$186,000;direct materials cost,$155,000.The following transactions took place during the year (all purchases and services were acquired on account):

a.Raw materials purchased,$96,000.

b.Raw materials requisitioned for use in production (all direct materials),$88,000.

c.Utility bills incurred in the factory,$17,000.

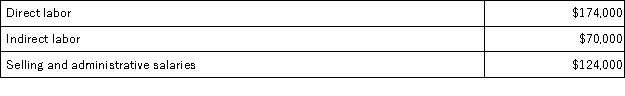

d.Costs for salaries and wages incurred as follows:  e.Maintenance costs incurred in the factory,$12,000.

e.Maintenance costs incurred in the factory,$12,000.

f.Advertising costs incurred,$98,000.

g.Depreciation recorded for the year,$75,000 (75 percent relates to factory assets and the remainder relates to selling,general,and administrative assets).

h.Rental cost incurred on buildings,$80,000 (80 percent of the space is occupied by the factory,and 20 percent is occupied by sales and administration).

i.Miscellaneous selling,general,and administrative costs incurred,$12,000.

j.Manufacturing overhead cost was applied to jobs.

k.Cost of goods manufactured for the year,$480,000.

l.Sales for the year (all on account)totaled $900,000.These goods cost $550,000 to manufacture.

Required:

Prepare journal entries to record the information above.Key your entries by the letters a through l.

Correct Answer:

Verified

Correct Answer:

Verified

Q5: During February, Irving Corporation incurred $65,000 of

Q36: During October, Beidleman Inc. transferred $52,000 from

Q48: In July, Essinger Inc. incurred $72,000 of

Q49: Parsons Corporation uses a predetermined overhead rate

Q56: Killian Corporation began operations on January 1.

Q125: Messana Corporation reported the following data for

Q126: Job 397 was recently completed.The following data

Q129: Buker Corporation bases its predetermined overhead rate

Q130: On August 1, Shead Corporation had $35,000

Q132: Dillon Corporation applies manufacturing overhead to jobs