Essay

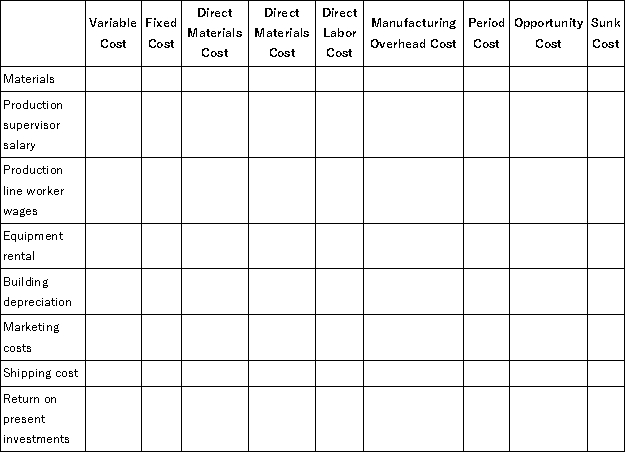

The Plastechnics Company began operations several years ago.The company's product requires materials that cost $25 per unit.The company employs a production supervisor whose salary is $2,000 per month.Production line workers are paid $15 per hour to manufacture and assemble the product.The company rents the equipment needed to produce the product at a rental cost of $1,500 per month.The building is depreciated on the straight-line basis at $9,000 per year.

The company spends $40,000 per year to market the product.Shipping costs for each unit are $20 per unit.

The company plans to liquidate several investments in order to expand production.These investments currently earn a return of $8,000 per year.

Required:

Complete the answer sheet below by placing an "X" under each heading that identifies the cost involved.The "Xs" can be placed under more than one heading for a single cost,e.g. ,a cost might be a sunk cost,an overhead cost,and a product cost.

Correct Answer:

Verified

Correct Answer:

Verified

Q43: A sunk cost is:<br>A)a cost which may

Q44: A partial listing of costs incurred during

Q48: Farnor,Inc. ,would like to estimate the variable

Q48: The costs of the Accounting Department at

Q54: The following costs were incurred in April:

Q76: Kodama Corporation staffs a helpline to answer

Q77: Fresh Wreath Corporation manufactures wreaths according to

Q101: Hadrana Corporation reports that at an activity

Q171: Indirect labor is a(n):<br>A)Prime cost.<br>B)Conversion cost.<br>C)Period cost.<br>D)Opportunity

Q173: Tolden Marketing, Inc., a merchandising company, reported