Multiple Choice

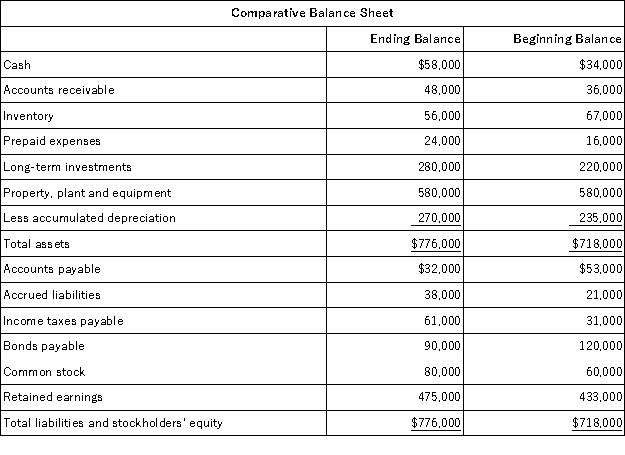

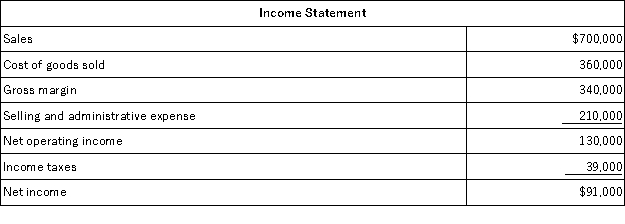

Van Beeber Corporation's comparative balance sheet and income statement for last year appear below:

The company declared and paid $49,000 in cash dividends during the year.It did not sell or retire any property,plant,and equipment during the year.The company uses the direct method to determine the net cash provided by operating activities. On the statement of cash flows,the income tax expense adjusted to a cash basis would be:

The company declared and paid $49,000 in cash dividends during the year.It did not sell or retire any property,plant,and equipment during the year.The company uses the direct method to determine the net cash provided by operating activities. On the statement of cash flows,the income tax expense adjusted to a cash basis would be:

A) $39,000

B) $69,000

C) $9,000

D) $25,000

Correct Answer:

Verified

Correct Answer:

Verified

Q13: Cridberg Corporation's selling and administrative expenses for

Q17: Dorris Corporation's balance sheet and income statement

Q19: The change in each of Kendall Corporation's

Q20: Van Beeber Corporation's comparative balance sheet and

Q24: The most recent balance sheet and income

Q25: The most recent balance sheet and income

Q26: The most recent balance sheet and income

Q27: Shimko Corporation's most recent comparative balance sheet

Q51: Evita Corporation prepares its statement of cash

Q130: Last year Anderson Corporation reported a cost