Essay

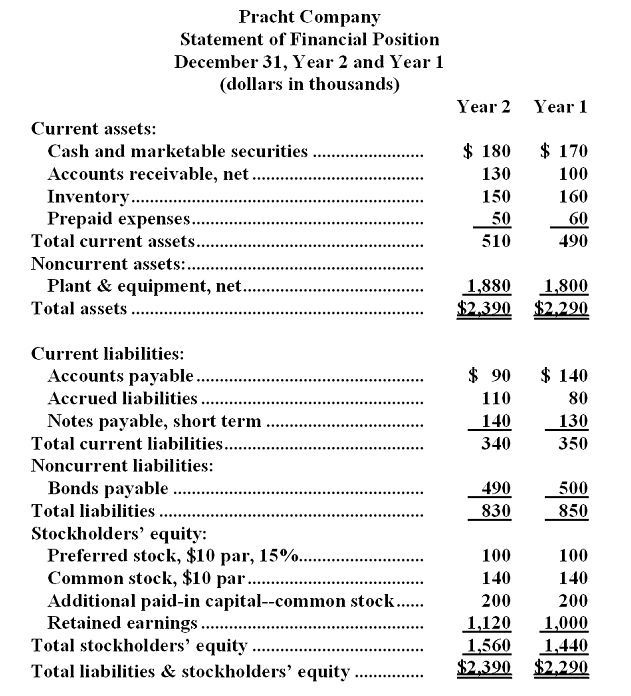

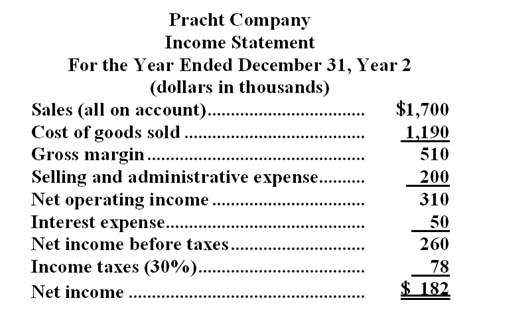

Financial statements for Pracht Company appear below: Pracht Company

Statement of Financial Position

December 31, Year 2 and Year 1

(dollars in thousands)

Dividends during Year 2 totaled $62 thousand,of which $15 thousand were preferred dividends.

The market price of a share of common stock on December 31,Year 2 was $160.

Required:

Compute the following for Year 2:

a.Earnings per share of common stock.

b.Price-earnings ratio.

c.Dividend payout ratio.

d.Dividend yield ratio.

e.Return on total assets.

f.Return on common stockholders' equity.

g.Book value per share.

h.Working capital.

i.Current ratio.

j.Acid-test ratio.

k.Accounts receivable turnover.

l.Average collection period.

m.Inventory turnover.

n.Average sale period.

o.Times interest earned.

p.Debt-to-equity ratio.

Correct Answer:

Verified

a.Earnings per share = (Net Income - Pre...View Answer

Unlock this answer now

Get Access to more Verified Answers free of charge

Correct Answer:

Verified

View Answer

Unlock this answer now

Get Access to more Verified Answers free of charge

Q191: Gulick Corporation's most recent income statement appears

Q192: Excerpts from Goodrow Corporation's most recent

Q193: Financial statements for Marcell Company appear below:

Q194: Deschambault Corporation's total current assets are $260,000,its

Q195: Basta Corporation's net income last year was

Q197: Assume a company has a current ratio

Q198: Excerpts from Zorra Corporation's most recent balance

Q199: What is the effect of a

Q200: The following selected data are for Geneva

Q201: Mclaughlin Corporation's most recent balance sheet and