Essay

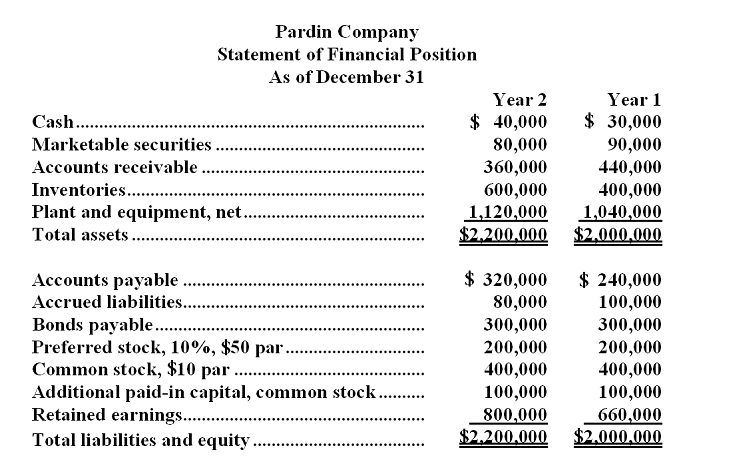

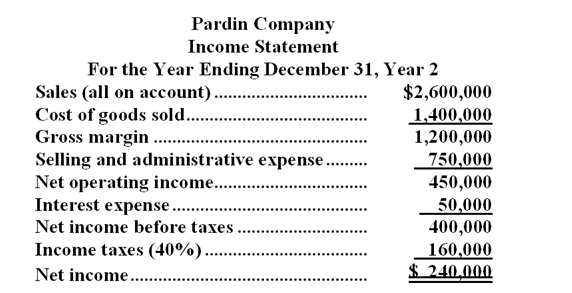

Condensed financial statements for Pardin Company are given below: Pardin Company

Statement of Financial Position

As of December 31

The company paid total dividends of $100,000 during the year.At the end of Year 2,the company's common stock was selling for $38 per share.

Required:

On the basis of the information given above,fill in the blanks with the appropriate figures:

Example: The current ratio at the end of Year 2 would be computed by dividing $1,080,000 by $400,000.

a.The acid-test ratio at the end of Year 2 would be computed by dividing _______________ by _________________.

b.The accounts receivable turnover during Year 2 would be computed by dividing _______________ by _________________.

c.The inventory turnover during Year 2 would be computed by dividing _______________ by _________________.

d.The times interest earned for Year 2 would be computed by dividing _______________ by _________________.

e.The earnings per share of common stock for Year 2 would be computed by dividing _______________ by _________________.

f.The return on total assets for Year 2 would be computed by dividing _______________ by _________________.

g.The debt-to-equity ratio at the end of Year 2 would be computed by dividing _______________ by _________________.

h.The dividend yield ratio would be computed by dividing _______________ by _________________.

i.The return on common stockholders' equity for Year 2 would be computed by dividing _______________ by _________________.

j.Whether the common stockholders gained or lost from the use of financial leverage during Year 2 would be determined by comparing the ratio computed in question ___ above to the ratio computed in question above ____.In this case,financial leverage is (positive/negative)___________________.

Correct Answer:

Verified

a.$480,000;$400,000

b.$2,600,000;$400,0...View Answer

Unlock this answer now

Get Access to more Verified Answers free of charge

Correct Answer:

Verified

b.$2,600,000;$400,0...

View Answer

Unlock this answer now

Get Access to more Verified Answers free of charge

Q11: Data from Paynter Corporation's most recent balance

Q12: Dieringer Corporation's most recent balance sheet and

Q13: Wolbers Company has an acid-test ratio of

Q14: Financial leverage is negative when:<br>A)the return on

Q15: Hick Corporation's most recent balance sheet and

Q17: Park Company purchased $100,000 in inventory from

Q18: Financial statements for Orange Company appear

Q19: The gross margin percentage is computed by

Q20: The formula for the gross margin percentage

Q21: Financial statements for Orange Company appear