Multiple Choice

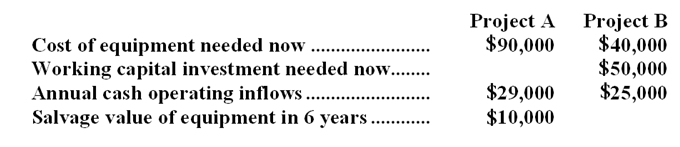

(Ignore income taxes in this problem.) Rushforth Manufacturing has $90,000 to invest in either Project A or Project B. The following data are available on these projects:  Both projects will have a useful life of 6 years. At the end of 6 years, the working capital investment will be released for use elsewhere. Rushforth's required rate of return is 14%.

Both projects will have a useful life of 6 years. At the end of 6 years, the working capital investment will be released for use elsewhere. Rushforth's required rate of return is 14%.

-The net present value of Project B is:

A) $57,225

B) $30,025

C) $7,225

D) $13,350

Correct Answer:

Verified

Correct Answer:

Verified

Q72: (Ignore income taxes in this problem. )Buy-Rite

Q73: The project profitability index is used to

Q74: (Ignore income taxes in this problem. )Tranter,Inc.

Q75: (Ignore income taxes in this problem. )Czaplinski

Q76: Blanding Company is considering several investment proposals,as

Q78: (Ignore income taxes in this problem. )The

Q80: (Ignore income taxes in this problem. )Dunay

Q81: The length of time required to recover

Q82: (Ignore income taxes in this problem.)

Q179: (Ignore income taxes in this problem.) Oriental