Multiple Choice

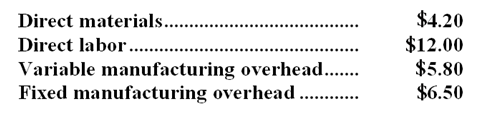

The Rodgers Company makes 27,000 units of a certain component each year for use in one of its products. The cost per unit for the component at this level of activity is as follows:  Rodgers has received an offer from an outside supplier who is willing to provide 27,000 units of this component each year at a price of $25 per component. Assume that direct labor is a variable cost. None of the fixed manufacturing overhead would be avoidable if this component were purchased from the outside supplier.

Rodgers has received an offer from an outside supplier who is willing to provide 27,000 units of this component each year at a price of $25 per component. Assume that direct labor is a variable cost. None of the fixed manufacturing overhead would be avoidable if this component were purchased from the outside supplier.

-Assume that if the component is purchased from the outside supplier,$35,100 of annual fixed manufacturing overhead would be avoided and the facilities now being used to make the component would be rented to another company for $64,800 per year.If Rodgers chooses to buy the component from the outside supplier under these circumstances,then the impact on annual net operating income due to accepting the offer would be:

A) $18,900 decrease

B) $18,900 increase

C) $21,400 decrease

D) $21,400 increase

Correct Answer:

Verified

Correct Answer:

Verified

Q122: The Tingey Company has 500 obsolete microcomputers

Q123: Talboe Company makes wheels which it uses

Q124: Dunford Company produces three products with the

Q125: Rothery Co.manufactures and sells medals for winners

Q126: Liffick Corporation is a specialty component manufacturer

Q128: The Immanuel Company has just obtained a

Q129: The management of Fries Corporation has been

Q130: Prevatte Corporation purchases potatoes from farmers.The potatoes

Q131: Marcell Corporation is considering two alternatives that

Q132: Pitkin Company produces a part used in