Multiple Choice

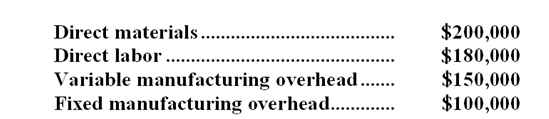

Meacham Company has traditionally made a subcomponent of its major product. Annual production of 20,000 subcomponents results in the following costs:  Meacham has received an offer from an outside supplier who is willing to provide 20,000 units of this subcomponent each year at a price of $28 per subcomponent. Meacham knows that the facilities now being used to make the subcomponent would be rented to another company for $75,000 per year if the subcomponent were purchased from the outside supplier. Otherwise, the fixed overhead would be unaffected.

Meacham has received an offer from an outside supplier who is willing to provide 20,000 units of this subcomponent each year at a price of $28 per subcomponent. Meacham knows that the facilities now being used to make the subcomponent would be rented to another company for $75,000 per year if the subcomponent were purchased from the outside supplier. Otherwise, the fixed overhead would be unaffected.

-If Meacham decides to purchase the subcomponent from the outside supplier,how much higher or lower will net operating income be than if Meacham continued to make the subcomponent?

A) $45,000 higher

B) $70,000 higher

C) $30,000 lower

D) $70,000 lower

Correct Answer:

Verified

Correct Answer:

Verified

Q11: Iwasaki Inc.is considering whether to continue to

Q12: Freestone Company is considering renting Machine Y

Q13: The Kelsh Company has two divisions--North and

Q14: Ellis Television makes and sells portable televisions.Each

Q15: Costs associated with two alternatives,code-named Q and

Q17: A study has been conducted to determine

Q18: Zurasky Corporation is considering two alternatives: A

Q19: Pappan Corporation makes three products that use

Q20: Mckerchie Inc. manufactures industrial components. One of

Q21: Future costs that do not differ among