Essay

Harris Corp.manufactures three products from a common input in a joint processing operation.Joint processing costs up to the split-off point total $200,000 per year.The company allocates these costs to the joint products on the basis of their total sales value at the split-off point.

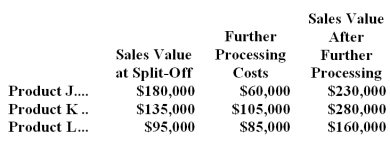

Each product may be sold at the split-off point or processed further.The additional processing costs and sales value after further processing for each product (on an annual basis)are:  The "Further Processing Costs" consist of variable and avoidable fixed costs.

The "Further Processing Costs" consist of variable and avoidable fixed costs.

Required:

Which product or products should be sold at the split-off point,and which product or products should be processed further? Show computations.

Correct Answer:

Verified

Product K should be sold afte...

Product K should be sold afte...View Answer

Unlock this answer now

Get Access to more Verified Answers free of charge

Correct Answer:

Verified

View Answer

Unlock this answer now

Get Access to more Verified Answers free of charge

Q112: Power Systems Inc.manufactures jet engines for the

Q113: Sunk costs are considered to be avoidable

Q114: Mr.Earl Pearl,accountant for Margie Knall Co. ,Inc.

Q115: The Varone Company makes a single product

Q116: Part N29 is used by Farman Corporation

Q118: Spurrier Corporation produces two intermediate products,A and

Q119: Elhard Company produces a single product. The

Q120: Sohr Corporation processes sugar beets that it

Q121: Scherer Corporation is preparing a bid for

Q122: The Tingey Company has 500 obsolete microcomputers