Essay

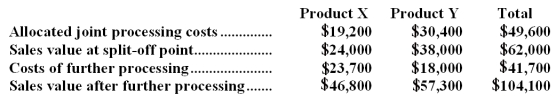

Iaukea Company makes two products from a common input.Joint processing costs up to the split-off point total $49,600 a year.The company allocates these costs to the joint products on the basis of their total sales values at the split-off point.Each product may be sold at the split-off point or processed further.Data concerning these products appear below:  Required:

Required:

a.What is the net monetary advantage (disadvantage)of processing Product X beyond the split-off point?

b.What is the net monetary advantage (disadvantage)of processing Product Y beyond the split-off point?

c.What is the minimum amount the company should accept for Product X if it is to be sold at the split-off point?

d.What is the minimum amount the company should accept for Product Y if it is to be sold at the split-off point?

Correct Answer:

Verified

Correct Answer:

Verified

Q133: Fillip Corporation makes 4,000 units of part

Q134: Dunford Company produces three products with the

Q135: Kempler Corporation processes sugar cane in batches.The

Q136: The management of Rodarmel Corporation is considering

Q137: The Western Company is considering the

Q139: Knaack Corporation is presently making part R20

Q140: The Cabinet Shoppe is considering the

Q141: The book value of a machine,as shown

Q142: Costs which are always relevant in decision

Q143: Marrin Corporation makes three products that use