Essay

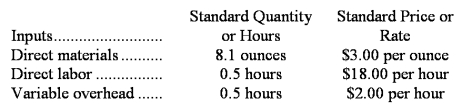

Leerar Corporation makes a product with the following standard costs:

In December the company produced 4,200 units using 34,870 ounces of the direct material and 1,900 direct labor-hours.During the month,the company purchased 39,700 ounces of the direct material at a total cost of $111,160.The actual direct labor cost for the month was $35,530 and the actual variable overhead cost was $3,990.The company applies variable overhead on the basis of direct labor-hours.The direct materials purchases variance is computed when the materials are purchased.

Required:

a.Compute the materials quantity variance.

b.Compute the materials price variance.

c.Compute the labor efficiency variance.

d.Compute the direct labor rate variance.

e.Compute the variable overhead efficiency variance.

f.Compute the variable overhead rate variance.

Correct Answer:

Verified

a.SQ = 4,200 units  8.1 ounces per unit ...

8.1 ounces per unit ...View Answer

Unlock this answer now

Get Access to more Verified Answers free of charge

Correct Answer:

Verified

View Answer

Unlock this answer now

Get Access to more Verified Answers free of charge

Q76: The Thompson Company uses standard costing and

Q77: Gentile Corporation makes a product with the

Q78: The following labor standards have been established

Q79: Davidson Corporation makes a product that has

Q80: Ruston Corporation applies manufacturing overhead to products

Q82: Hurren Corporation makes a product with the

Q83: The following materials standards have been established

Q84: Sande Corporation makes a product with the

Q85: Tidd Corporation makes a product with the

Q86: Mazzo Corporation makes a product with the